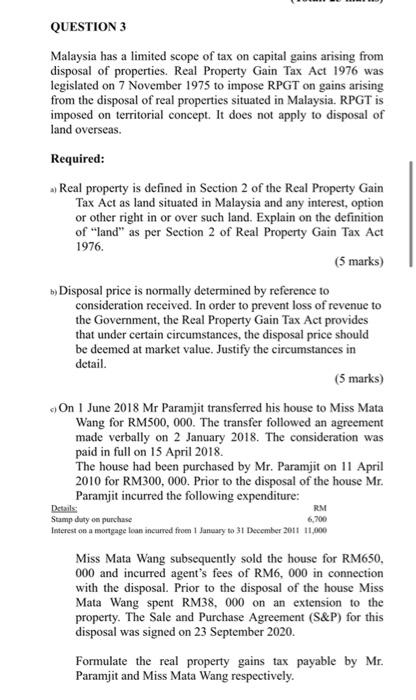

stamp duty act malaysia

Stamp duty is generally payable at the time of purchase or very soon after. Iran Air Flight 655 was a scheduled passenger flight from Tehran to Dubai via Bandar Abbas that was shot down on 3 July 1988 by two SM-2MR surface-to-air missiles fired by the USS Vincennes a guided-missile cruiser of the United States NavyThe aircraft an Airbus A300 was destroyed and all 290 people on board were killed.

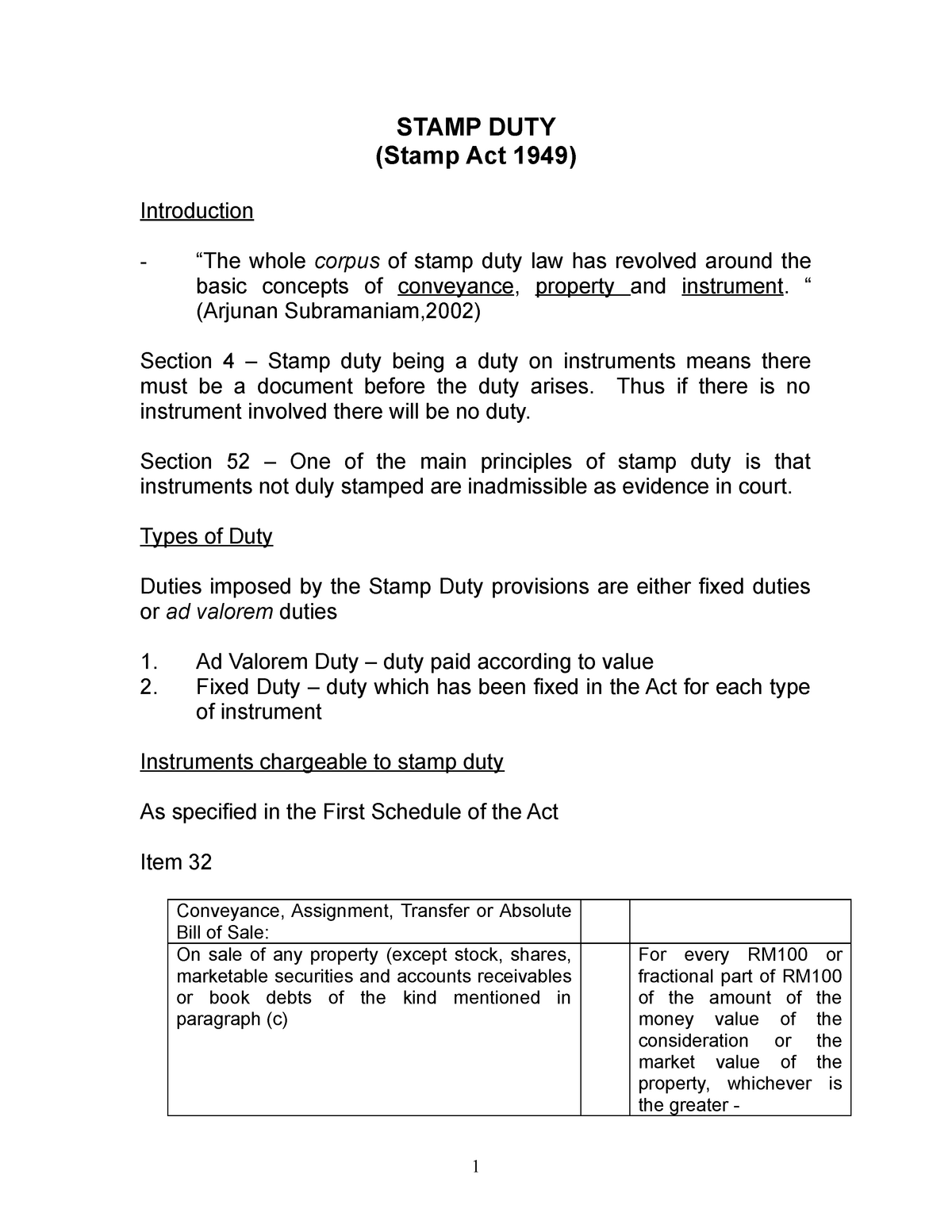

Meaning loan stocks and shares of public companies listed on the Bursa Malaysia Berhad shares of other companies and of non-tangible property eg.

. Sabah and Sarawak 1 October 1989 PU. United Kingdom insolvency law regulates companies in the United Kingdom which are unable to repay their debts. Stamp duty is payable under Section 3 of the Indian Stamp Act 1899.

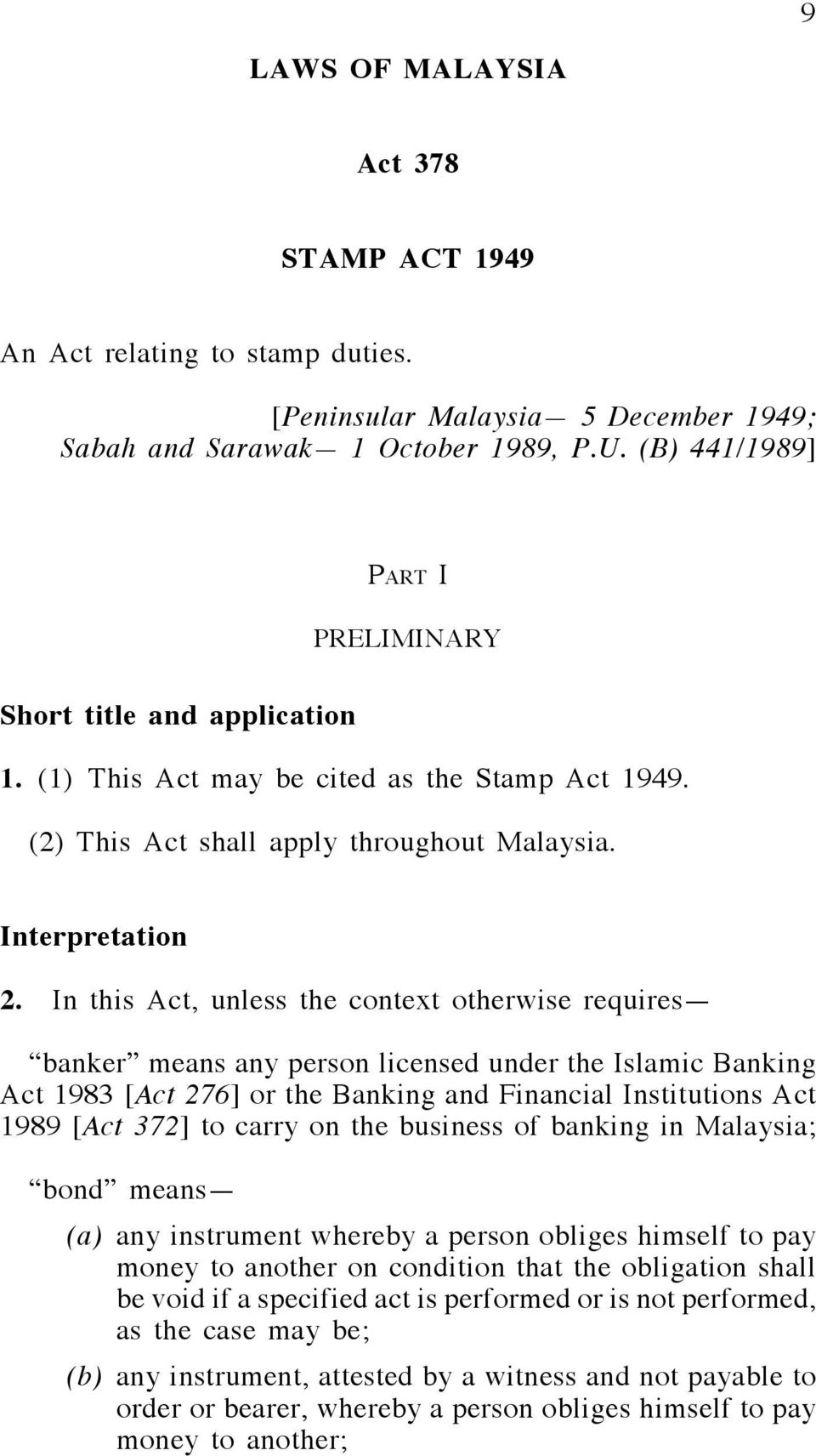

The stamp duty for a tenancy agreement in Malaysia is calculated as the following. Book debts benefits to legal rights and. Do I need to pay stamp duty on non-residential property.

Buyers will be sent this in an email sometime. Table of Contents Latest Updated. Stamp Duty On Contract Notes In Relation To Sale Or Purchase Of Debentures Listed On Bursa.

SAC of Bank Negara Malaysia BNM. While UK bankruptcy law concerns the rules for natural persons the term insolvency is generally used for companies formed under the Companies Act 2006. The Stamp Act of 1712 was an act passed in the United Kingdom on 1 August 1712 to create a new tax on publishers particularly of newspapers.

Stamp duty exemption on instrument of agreement for a loan or financing in relation to a Micro Financing. An instrument relating to the sale and purchase of retail debenture and retail sukuk as approved by the Securities Commission under the Capital Markets and Services Act 2007 Act 671 are exempted from stamp duty. What are the changes to Stamp Duty when buying a UK second home or buy to let in the UK from 1st April 2016.

ACT payable within 28 days of settlement purchasers must pay stamp duty within 14 days of receiving a Notice of Assessment from Access Canberra. Stamp duty is a tax payable to the relevant state or territory when you purchase or acquire an interest in a commercial property. When purchasing non-residential property in England or Wales you are still obliged to pay Stamp Duty Land Tax SDLT - a tax levied on property transactions and payable to Inland Revenue - on non-residential assets above the value of 150000 as it currently stands.

The Financial Services Act 2013 FSA 2013 Islamic Financial Services Act 2013 IFSA 2013 and other changes. The stamp duty is free if. B 4411989 PART I PRELIMINARY Short title and application 1.

Stamp duty exemption on loanfinancing agreements executed from 1 January 2022 to 31 December 2026 between MSMEs and investors for funds raised on a peer-to-peer P2P platform registered and recognised by the Securities Commission Malaysia. When do you have to pay stamp duty. The rates are different for first-time buyers.

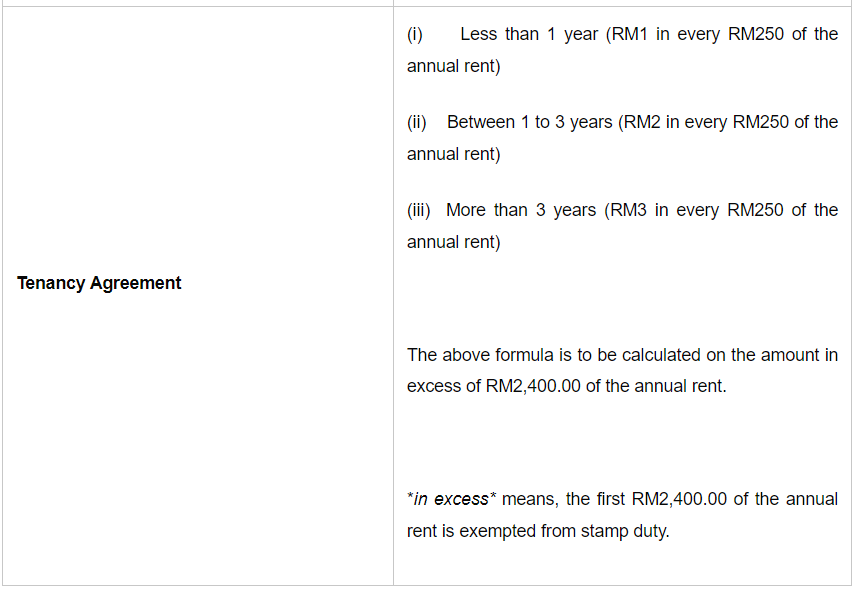

The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949. Stamp Duty is a tax on dutiable documents relating to immovable properties in Singapore and stocks and shares. ASCII characters only characters found on a standard US keyboard.

Latest news expert advice and information on money. Insolvency means being unable to pay debts. The initial assessed rate of tax was one penny per whole newspaper sheet a halfpenny for a half sheet and one shilling per advertisement contained within.

30 June 2021. Also read all about income tax provisions for TDS on rent. Other than newspapers it required that all pamphlets legal documents.

Your conveyancer or legal adviser can do the paperwork. For instance the famous Wankhede cricket stadium in Mumbai Maharashtra is in a total of 13 acres of land that is equal to 56629064 sq. The jet was hit while flying over Irans territorial waters.

6 to 30 characters long. 2 This Act shall apply throughout Malaysia. Rules of Bursa Malaysia Securities Latest Updated.

Stamp duty is the governments charge levied on different property transactions. Tenancy agreement between 1 to 3 years RM2 for every RM250 of the annual rent above RM2400. Foreign Account Tax Compliance Act FATCA Go to next level.

It is a tax paid to the government similar to the income tax. As per the Stamp Duty Act 1949 revised 1989 ASNB Certificate Fee. B sends an email from Singapore accepting As offer.

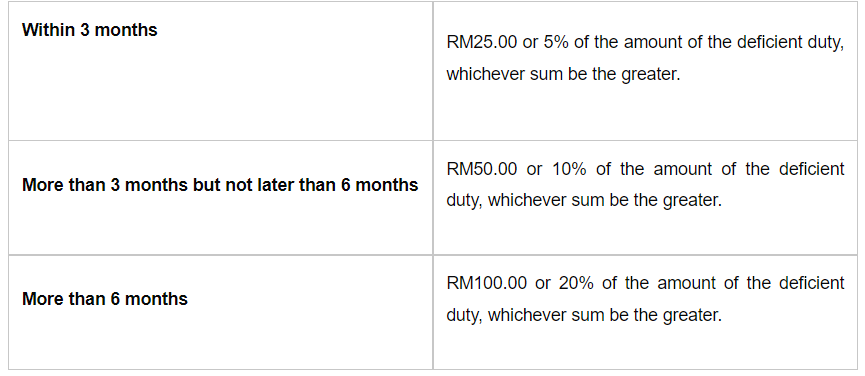

If payment of the stamp duty is delayed it will incur a fine. 1 This Act may be cited as the Stamp Act 1949. The stamp duty shall be remitted to the maximum of RM200.

Just as the stamp duty rate varies from state to state so does the timeframe in which people need to pay it. Foreign Account Tax Compliance Act FATCA. Generally the stamp duty is paid by the buyer in some cases the buyer and seller decide to split the stamp duty as per an earlier signed agreement.

From the 1st April 2016 anyone purchasing a property in addition to their main home will pay an additional 3 SDLT for the first 125000 and 5 instead of 2 on the portion between 125001 and 250000 and 8 on the amount above 250001. Stamp duties are payable pursuant to Section 3 of the Indian Stamp Act 1899. Since the Cork Report of 1982 the modern policy of UK.

Find stories updates and expert opinion. Latest breaking news including politics crime and celebrity. A sends an email from Malaysia offering to sell property to B.

A revenue stamp tax stamp duty stamp or fiscal stamp is a usually adhesive label used to designate collected taxes or fees on documents tobacco alcoholic drinks drugs and medicines playing cards hunting licenses firearm registration and many other thingsTypically businesses purchase the stamps from the government thereby paying the tax and attach them to taxed. First-time buyers will not pay any stamp duty on the first 425000 up from 300000 following the mini-Budget and the value of any property on which they can claim this relief has risen to 625000 from 500000. What is stamp duty.

The stamp duty is free if the annual rental is below RM2400. Must contain at least 4 different symbols. In fact its one of the main sources of government revenue.

1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400. LAWS OF MALAYSIA Act 378 STAMP ACT 1949 An Act relating to stamp duties. Peninsular Malaysia 5 December 1949.

There is no stamp duty Tax applied to the first 250000. Stamp duty in India is governed by two legislations ie a stamp Act legislated by the Parliament and a stamp Act legislated by the state legislature. Stamp duty on rental agreements.

Pensions property and more. All eligible ASB investors under ASNB guidelines who. You need to pay a stamp duty when you buy a property and also when you go in for a rental agreement.

3 January 2022. The law on stamping and registration. Along with India the US UK Canada Bangladesh Pakistan Nepal Hong Kong Ghana Singapore and Malaysia are the other countries that use square feet for the measurement of the land.

Insurance Optional Will Fee If any. Stamp Duty is payable in full and is to be paid on the deadline.

Stamp Duty Remission Granted To Malaysian Taxpayer International Tax Review

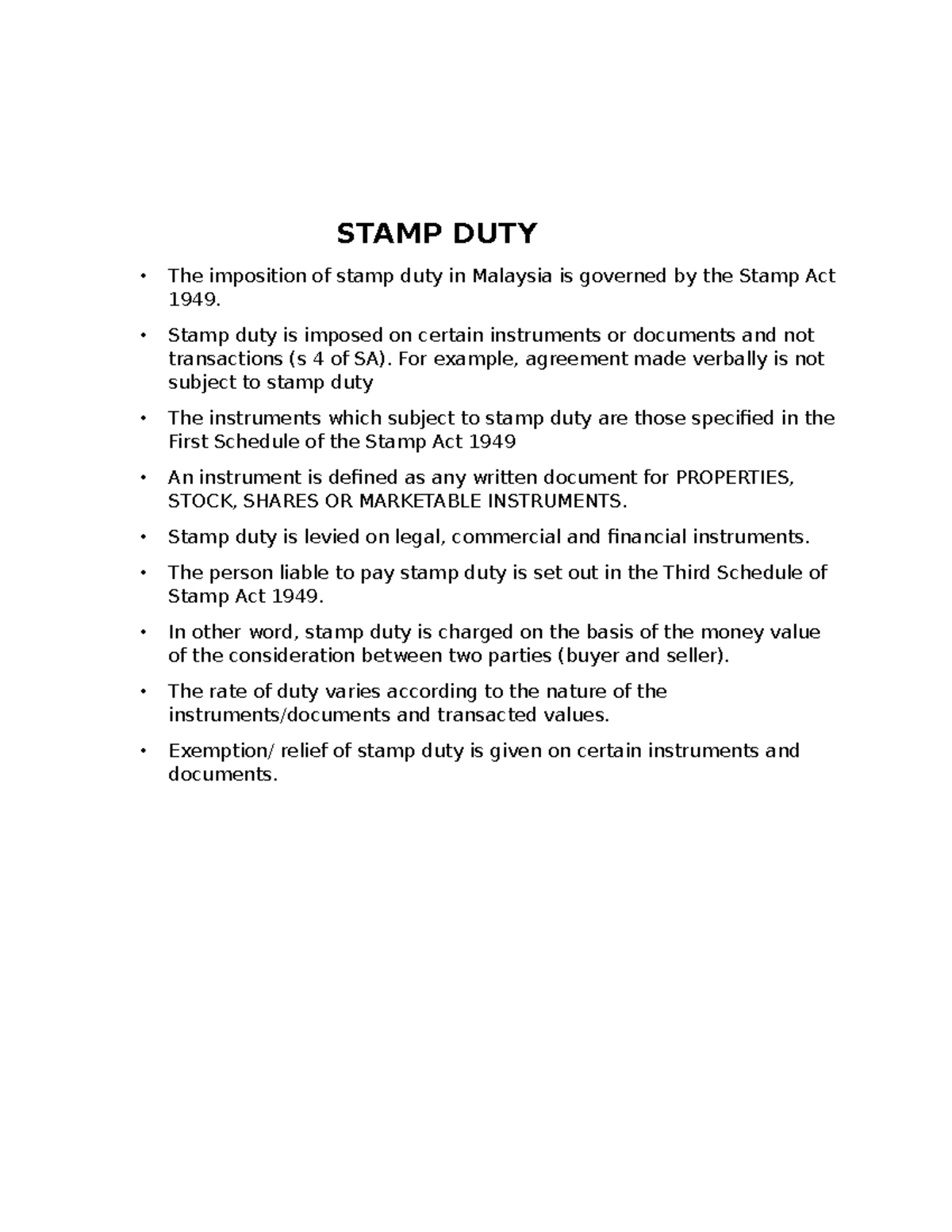

Solved Question 3 Malaysia Has A Limited Scope Of Tax On Chegg Com

Stamp Laws Of Malaysia Reprint Act 378 Stamp Act Pdf Free Download

Pdf Tax Simplicity And Small Business In Malaysia Past Developments And The Future Semantic Scholar

Malaysian Tax Law Stamp Duty Lexology

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Real Estate Malaysia

Changes Proposed To Stamp Act In Malaysia Conventus Law

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Chapter 10 Stamp Duty Pptx Chapter 10 Stamp Duty Bkat 3033 Specialised Taxation Second Semester 2018 2019 Lee Wui Min Nur Amirah Hanis Binti Abd Course Hero

Stamp Duty 1 Introduction Notes Stamp Duty The Imposition Of Stamp Duty In Malaysia Is Governed Studocu

Stamp Duty And Contracts Yee Partners

Hasani Ilbs Stamp Act 1949 Act 378 And Selected Rules 15 April 2022 9789678929349 Shopee Malaysia

Stamp Act 1949 Laws Of Malaysia Online Version Of Updated Text Of Reprint Act 378 Stamp Act 1949 Studocu

Malaysian Tax Law Stamp Duty Lexology

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Stamp Duty Notes Statutory Valuation For Auction Rating Wayleave Easement Stamp Duty Stamp Studocu

Comments

Post a Comment